Stanbic IBTC Holdings Plc, Lagos Business School Sustainability Centre Collaborate To Host 2025 Sustainable Finance Summit 2.0

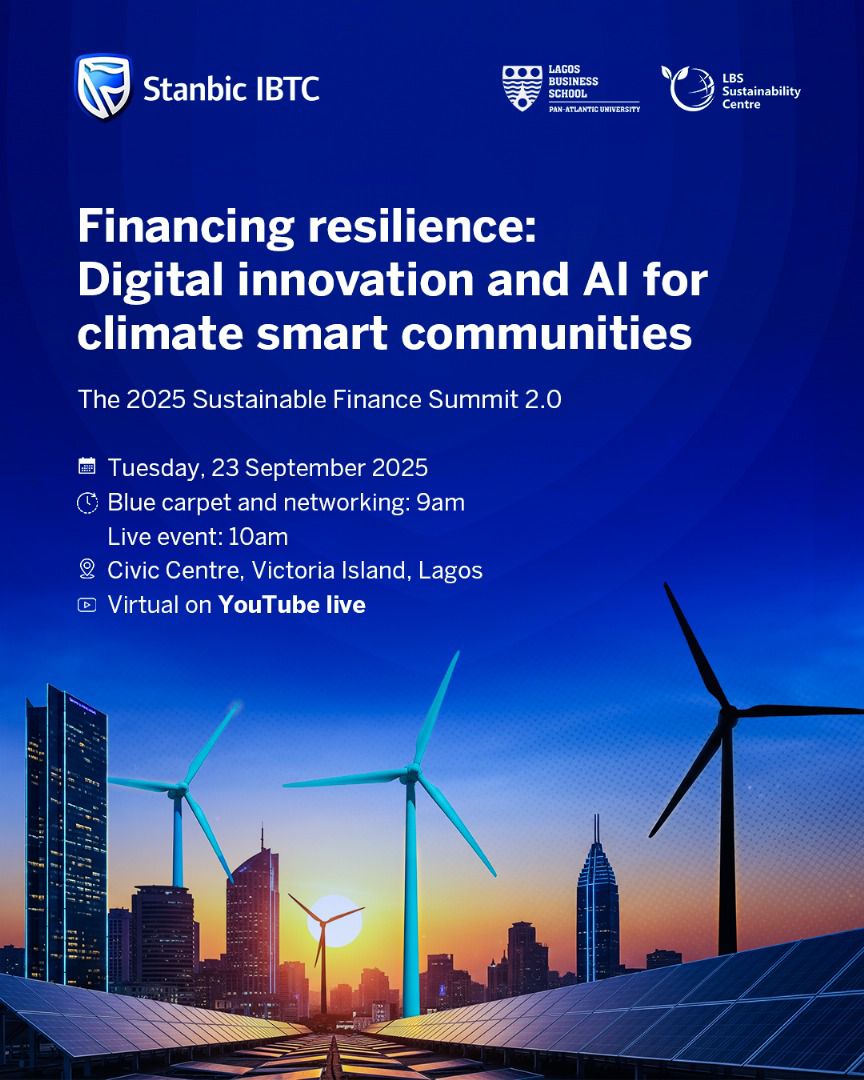

Stanbic IBTC Holdings Plc in partnership with the Lagos Business School (LBS) Sustainability Centre, will convene the 2025 Sustainable Finance Summit 2.0 themed: “Financing Resilience: Digital Innovation and AI for Climate-Smart Communities.”

The event will take place on Tuesday, 23rd September, 2025, at the Civic Centre, Victoria Island, Lagos.

The summit is expected to bring together an ecosystem of players in the sustainable finance sector spanning the financial services, development, sustainability and technology sectors.

Registration for the summit is open for in-person participation – https://events.lbs.edu.ng/SUSTAINABLEFINANCESUMMIT2025

Globally, traditional financing models are undergoing recalibration to catalyse sustainable development, driven by digitization and Artificial Intelligence.

Africa is not left out, and the financial services sector is uniquely positioned to play a pivotal role.

The event will serve as a platform to explore transformative approaches to sustainable financing powered by digitization and artificial intelligence. With fintech adoption in Nigeria alone growing by over 200% in the last five years, digital innovation and AI present powerful tools to bridge financing gaps, scale sustainable solutions, and create inclusive financial systems for underserved markets.

Mrs. Tosin Leye-Odeyemi, Head, Sustainability, Risk and Capital Management at Stanbic IBTC Holdings Plc, conveys Stanbic’s commitment to driving sustainable innovation in finance: “At Stanbic IBTC, we are constantly thinking of what we can do differently to achieve the systemic changes required in finance riding on the back of digitization and Artificial Intelligence which is changing the way the financial services industry analyses, understands and shapes finance, business and investments.

She further disclosed that the summit affords ecosystem players the opportunity to share insights, showcase solutions, and navigate change together for the good of the continent as a whole.”

She added, “At Stanbic IBTC, we are thinking about the future and recognise that the future of finance must serve both people and the planet. We are proud to partner with the Lagos Business School Sustainability Centre to push this agenda forward for Nigeria and Africa.”

The urgency could not be greater. Africa currently loses an estimated 7–15 billion USD annually to climate change impacts, a figure projected to rise to 50 billion USD by 2040 without decisive action. At the same time, the continent faces a 1.3 trillion USD sustainable financing gap by 2030 according to the United Nations Economic Commission for Africa (UNECA).

The Sustainable Finance Summit 2.0 is anchored on four strategic objectives: advancing Nigeria and Africa’s role in the global sustainable finance architecture through homegrown innovations; strengthening policy frameworks and identifying regulatory enablers for digital sustainable finance; mobilising partnerships across the public and private sectors to scale impact; and showcasing cutting-edge AI and digitisation applications that drive and future-proof ESG-aligned investments across the continent.

Oreva Atanya, Director, LBS Sustainability Centre said, “ The summit’s objectives are aligned with the UN Sustainable Development Goals (SDGs), the G20 Sustainable Finance Roadmap, the African Union Agenda 2063, the African Continental Free Trade Area (AfCFTA) agreement, and Nigeria’s National AI Strategy, all geared towards harnessing the potential of critical sectors on the continent by connecting the dots with various developmental frameworks and aspirations across national, regional, and global levels, positioning Nigeria and Africa as a proactive contributor to the global sustainable finance agenda.”

The one-day summit will feature High-level remarks, a keynote address, insight presentations, high-level panel discussions, and a “blue carpet” networking session, offering participants the opportunity to connect, engage, and forge partnerships that will redefine the future of finance on the continent.

Registration for the summit is open for in-person participation – https://events.lbs.edu.ng/SUSTAINABLEFINANCESUMMIT2025

For enquiries, contact: Ms. Opeyemi Ogunkoya (opeyemi.ogunkoya@stanbicibtc.com); Mr. Abam Inyang (ainyang@lbs.edu.ng | +234 805 622 1994); or Ms. Osanua Nwagbara (onwagbara@lbs.edu.ng | +234 816 627 4211)

2025 Sustainable Finance Summit 2.0

Stanbic IBTC Holdings Plc in partnership with the Lagos Business School (LBS) Sustainability Centre, will convene the 2025 Sustainable Finance Summit 2.0 themed: “Financing Resilience: Digital Innovation and AI for Climate-Smart Communities.”

The event will take place on Tuesday, 23rd September, 2025, at the Civic Centre, Victoria Island, Lagos.

The summit is expected to bring together an ecosystem of players in the sustainable finance sector spanning the financial services, development, sustainability and technology sectors.

Registration for the summit is open for in-person participation – https://events.lbs.edu.ng/SUSTAINABLEFINANCESUMMIT2025

Globally, traditional financing models are undergoing recalibration to catalyse sustainable development, driven by digitization and Artificial Intelligence.

Africa is not left out, and the financial services sector is uniquely positioned to play a pivotal role.

The event will serve as a platform to explore transformative approaches to sustainable financing powered by digitization and artificial intelligence. With fintech adoption in Nigeria alone growing by over 200% in the last five years, digital innovation and AI present powerful tools to bridge financing gaps, scale sustainable solutions, and create inclusive financial systems for underserved markets.

Mrs. Tosin Leye-Odeyemi, Head, Sustainability, Risk and Capital Management at Stanbic IBTC Holdings Plc, conveys Stanbic’s commitment to driving sustainable innovation in finance: “At Stanbic IBTC, we are constantly thinking of what we can do differently to achieve the systemic changes required in finance riding on the back of digitization and Artificial Intelligence which is changing the way the financial services industry analyses, understands and shapes finance, business and investments.

She further disclosed that the summit affords ecosystem players the opportunity to share insights, showcase solutions, and navigate change together for the good of the continent as a whole.”

She added, “At Stanbic IBTC, we are thinking about the future and recognise that the future of finance must serve both people and the planet. We are proud to partner with the Lagos Business School Sustainability Centre to push this agenda forward for Nigeria and Africa.”

The urgency could not be greater. Africa currently loses an estimated 7–15 billion USD annually to climate change impacts, a figure projected to rise to 50 billion USD by 2040 without decisive action. At the same time, the continent faces a 1.3 trillion USD sustainable financing gap by 2030 according to the United Nations Economic Commission for Africa (UNECA).

The Sustainable Finance Summit 2.0 is anchored on four strategic objectives: advancing Nigeria and Africa’s role in the global sustainable finance architecture through homegrown innovations; strengthening policy frameworks and identifying regulatory enablers for digital sustainable finance; mobilising partnerships across the public and private sectors to scale impact; and showcasing cutting-edge AI and digitisation applications that drive and future-proof ESG-aligned investments across the continent.

Oreva Atanya, Director, LBS Sustainability Centre said, “ The summit’s objectives are aligned with the UN Sustainable Development Goals (SDGs), the G20 Sustainable Finance Roadmap, the African Union Agenda 2063, the African Continental Free Trade Area (AfCFTA) agreement, and Nigeria’s National AI Strategy, all geared towards harnessing the potential of critical sectors on the continent by connecting the dots with various developmental frameworks and aspirations across national, regional, and global levels, positioning Nigeria and Africa as a proactive contributor to the global sustainable finance agenda.”

The one-day summit will feature High-level remarks, a keynote address, insight presentations, high-level panel discussions, and a “blue carpet” networking session, offering participants the opportunity to connect, engage, and forge partnerships that will redefine the future of finance on the continent.

Registration for the summit is open for in-person participation – https://events.lbs.edu.ng/SUSTAINABLEFINANCESUMMIT2025

For enquiries, contact: Ms. Opeyemi Ogunkoya (opeyemi.ogunkoya@stanbicibtc.com); Mr. Abam Inyang (ainyang@lbs.edu.ng | +234 805 622 1994); or Ms. Osanua Nwagbara (onwagbara@lbs.edu.ng | +234 816 627 4211)