In recent remarks about the economy, President Bola Ahmed Tinubu has consistently affirmed that every hardworking Nigerian deserves access to structured consumer credit that expands opportunity and improves quality of life.

On Democracy Day 2025, he reiterated this commitment, announcing the phased rollout of the “YouthCred” programme of the Nigerian Consumer Credit Corporation (CREDICORP)—beginning with NYSC Corps Members and expanding to all employed young Nigerians.

The YouthCred NYSC Pilot, launched in July 2025, quickly became Nigeria’s flagship youth credit intervention. Over 51,000 Corps Members enrolled, receiving structured credit education and varying levels of affordable credit. Beneficiaries used YouthCred to acquire mobility, digital devices, solar energy, work tools, and other essentials that supported their transition into productive post-service life. The strong uptake confirmed a nationwide demand for simple, fair, responsible consumer credit.

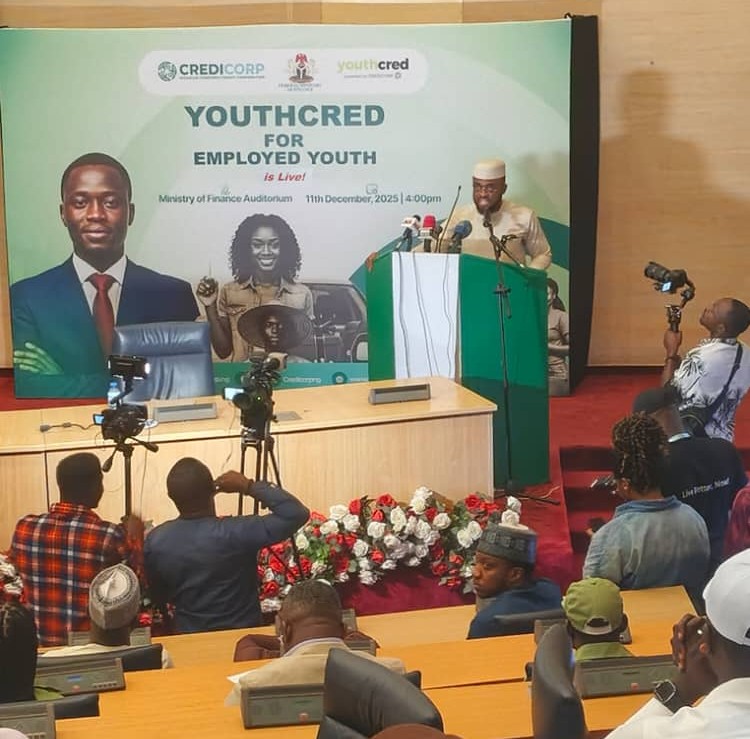

Building on this success, the Federal Government has now launched the Employed Youth Phase of YouthCred, opening access to affordable consumer credit for young working Nigerians aged 18–39. The programme was unveiled by the Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, at the Ministry of Finance Auditorium in Abuja.

This new phase extends YouthCred to millions of employed Nigerians across public and private sectors who earn steady incomes but remain excluded from formal credit. Beneficiaries, via CREDICORP’s partner financial institutions, can now access loans of up to ₦3 million—for mobility, solar systems, rental support, household upgrades, digital devices, and work tools—through a fully digital process with clear terms and mandatory credit education that promotes responsible borrowing.

Speaking at the launch, the Honourable Minister described YouthCred for Employed Youth as the practical expression of President Tinubu’s vision for a modern, credit-enabled economy. He stressed that as government reforms strengthen the economy, Nigerians must also feel these gains in their daily lives through access to tools that make them more productive and financially secure.

CREDICORP’s Managing Director, Uzoma Nwagba, noted that YouthCred has grown from a pilot into a national pathway for youth empowerment. He emphasised that the expansion reflects both the scale of demand and the administration’s commitment to unlocking opportunity for millions of young Nigerians through the country’s most affordable structured credit.

With this rollout, the Federal Government has opened a major new channel for youth credit access, reinforcing its commitment to financial inclusion and shared prosperity.

Young Nigerians aged 18–39 can begin their YouthCred journey by completing mandatory credit education and applying—no collateral required—at www.youthcred.com.