The Executive Chairman of the Economic and Financial Crimes Commission (EFCC), Mr. Ola Olukoyede, has reaffirmed the Commission’s commitment to working with responsible financial institutions to strengthen regulatory compliance and safeguard Nigeria’s financial system.

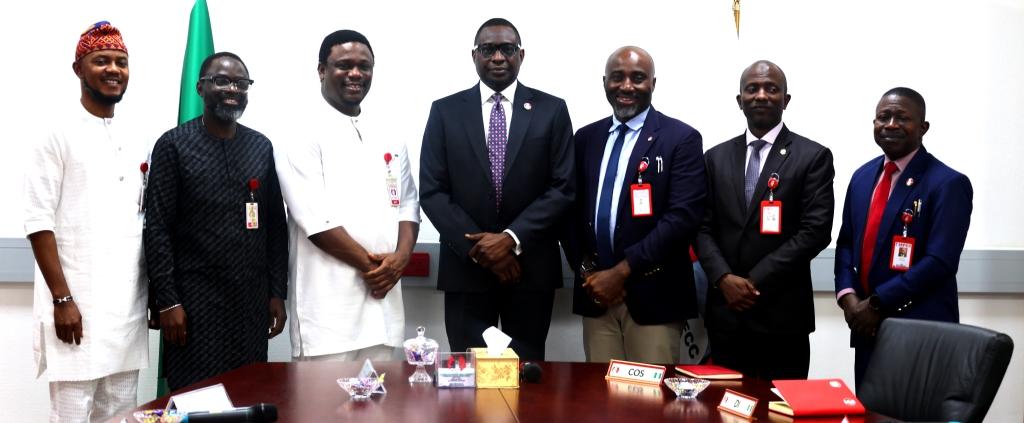

Olukoyede gave the assurance on Thursday, January 22, 2026, when the management of Moniepoint Microfinance Bank, led by its Founder and Chief Executive Officer, Mr. Tosin Eniolorunda, paid a courtesy visit to the EFCC headquarters in Jabi, Abuja.

A statement by the Head, Media and Publicity of EFCC, Dele Oyewale,disclosed that during the visit, the EFCC boss underscored the importance of strict adherence to regulatory standards and robust due diligence processes, noting that compliance is critical to sustaining growth and protecting financial platforms from abuse by criminal elements.

He emphasized that effective Know Your Customer (KYC) procedures and compliance with existing regulations, including those issued by the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC), would further strengthen the fintech ecosystem and prevent money laundering and terrorism financing.

“Take your time, play by the rules, follow the law and always address your mind to doing the right thing,” Olukoyede advised, adding that regulatory compliance is essential for any business seeking long-term success.

He also commended Moniepoint’s leadership for its resilience, innovation, and contribution to job creation and financial inclusion in Nigeria.

“Anybody who has grown a business to the level of employing people in Nigeria deserves a salute. I salute your courage. Nurturing an idea to this level is no small feat,” he said.

In his response, Eniolorunda assured the EFCC of Moniepoint’s unwavering commitment to regulatory compliance, safety, and integrity in all its operations. He noted that the bank recognizes its growing impact in society and remains fully committed to anti-fraud and anti-money laundering frameworks.

“These are responsibilities we have taken very seriously over the years. We have grown through different phases and are now in a maturity stage where we have successfully addressed many of the fraud challenges that once affected the fintech space,” he stated.

He further highlighted the bank’s continuous efforts to verify account ownership and ensure transaction security, while also emphasizing the positive impact of Moniepoint’s solutions on businesses across the country.

“Our platforms have improved payment reliability for small and medium-scale businesses and expanded access to credit within the economy,” Eniolorunda added.

The visit underscored the shared commitment of both institutions to promoting transparency, innovation, and confidence in Nigeria’s financial system.