The Director-General of the National Information Technology Development Agency (NITDA), Kashifu Inuwa, has stated that digitising the Nation’s Micro, Small and Medium Enterprises (MSMEs) will drive the needed sustainable economic growth, adding that digitalisation and technology play critical roles in optimising the operation of businesses in the 21st century.

The DG disclosed this in Abuja while delivering a Keynote Address on the theme: “Digital Nigeria – Leveraging Technology to Improve Ease of Doing Business for MSMEs” at the Development Bank of Nigeria (DBN) 2023 Annual Lecture series.

According to Inuwa, technology innovation is occurring exponentially, and businesses are increasingly recognising and leveraging technology for growth. He quoted a 2020 PwC MSME survey which states that MSMEs account for about 96 percent of all businesses in Nigeria; contribute 49 percent of the national Gross Domestic Product (GDP); and employ 84 percent of the country’s workforce.

The DG took his audience through the process of starting a business, stressing that technology has helped the government to provide an easy way for anyone to register a business from anywhere, within 24 hours, which he said is quite unlike the past when one would need to travel to Abuja from states for the same purpose.

“As a government, we have the responsibility to carry everyone along, especially when it comes to inclusivity or access to digital infrastructure, it is no longer a privilege but a necessity”.

“With the way, we are increasingly using systems to make decisions and a whole lot of things, there is a need to carry everyone along as we cannot afford to be left behind in Nigeria, Africa, and the rest of the world.”, Inuwa maintained.

According to him, “We are rounding off with legal framework that will make it easier for investors to come and invest in digital public infrastructure because this will make it a lot easier for SMEs would aid automation of governance”.

“Nigeria has the largest vibrant tech ecosystem in Africa as the country is leading so far in unicorn counts on the continent with five of the seven known unicorns originating in Nigeria”, Inuwa said.

The sustenance of Nigeria’s economy, Inuwa stressed, relies heavily on enterprises, given the trajectory of customer satisfaction, advertising, and payment are results of the increased attention turned to digitalisation in today’s businesses.

“MSMEs that have embraced digitalisation and technology tend to fare better and that underscores a study done in Turkey which shows that 41.2 percent of 131 SMEs underwent technological innovations and this led to operational efficiency of 96.9 percent.

“With the power of technology, you start small but in the long run, you will grow exponentially, if you continue to add value to your business, of course”, the DG avowed.

While painting a picture of what the MSMEs in Nigeria could add to the country’s GDP through digitisation, the Director-General appealed to the Development Bank of Nigeria to also consider giving Startups access to funds as they do MSMEs, adding that the two are the same, with the only difference being their nomenclatures.

“If all SMEs in Nigeria can digitise today, we can add $60 Billion by just leveraging technology and recent research has shown that any MSME that transformed digitally could increase its revenue by 26 percent and reduce costs by 22 percent “, the DG assured.

The NITDA Boss who highlighted and explained the seven points Strategic Roadmap Pillars of the Agency, said the Federal Government is committed to digitally transforming the economy.

“Today, we collaborate more with the Western countries than our neighbours, this shows that we are the next frontier when it comes to a digital economy”, Inuwa said.

Inuwa harped on the need to foster collaborations with key development partners and build strong institutions to deliver and execute all the digital visions in Nigeria, maintaining that the focus of the digital vision remains to uplift Nigeria through digital transformation and innovation.

“Start-ups and MSMEs are the engine room for digital transformation and innovation, therefore, I want to encourage DBN to keep up the good work and also receive the need to include tech startups in all your funding schemes”, Inuwa concluded.

Earlier in his welcome speech, the Chief Executive Officer (CEO), Development Bank of Nigeria, Dr. Tony Okpanachi, alluded to the fact that the discovery of the internet and its impact on human interaction and commerce have changed the dynamics of human coexistence, as Facebook, Instagram, LinkedIn and other social platforms which started as a means of interaction between people now have commercial and advertising nodes to them, promoting not just social exchange, but also fulfilling an economic need through hyperlinking, interactivity and multimodality.

Dr. Okpanachi disclosed that although internet penetration is still at 55.4 percent in Nigeria, according to DataReportal’s report, which suggests that there were 122.5 million internet users in Nigeria in January 2023, there is a strong need to plot how extant technology, and the new upcoming ones can be used to shore up the Ease of Doing Business in Nigeria which sits at 131 out of 190 economies, on the Ease of Doing Business (EODB) Rank.

“While issues like security, and poor infrastructure have bedeviled the country for so long, the country must look to other means that transcend these major roadblocks, one of which is technology, and a digitised business environment”.

“MSMEs in Nigeria play a crucial role in economic growth, poverty reduction, employment creation, as well as shared wealth creation and by leveraging technology within their operations, companies can improve their efficiencies, which is one of the roadblocks to doing business in Nigeria”, Dr. Okpanachi noted.

The CEO affirmed that the DBN’s Annual Lecture Series is a platform that advocates for MSME financing in Nigeria, and leads the conversation on how technology can drive innovation, resilience, and profitability for MSMEs.

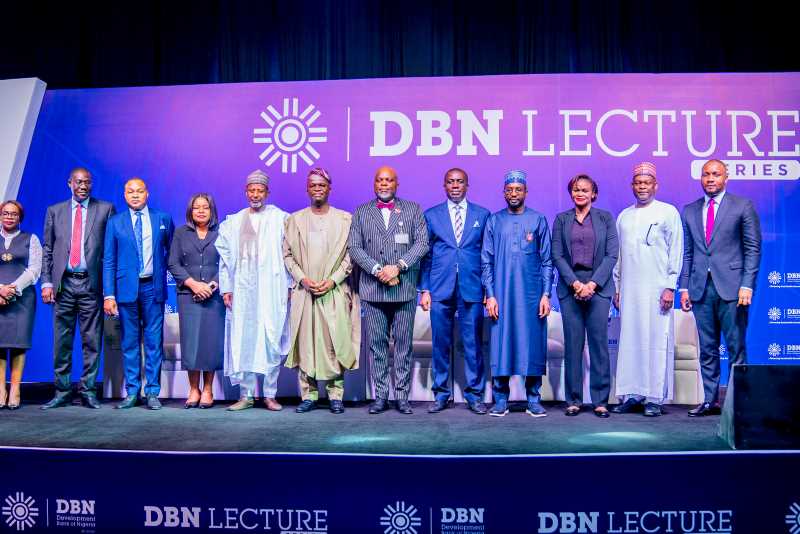

The fourth DBN Annual Lecture hybrid event marked the bank’s 6th anniversary and to celebrate the milestone, the Bank’s Lecture featured speakers drawn from a range of subject matter expertise, comprising public sector, academia, development economics, financial services, and entrepreneurship.

The event also featured keynotes and panel sessions, where the facilitators shared their perspectives on how to drive sustainable business growth with technology that adapts to a green economy.